37+ pay off mortgage with 401k cares act

Reduced investments if you pull from. LawDepot Has You Covered with a Wide Variety of Legal Documents.

:max_bytes(150000):strip_icc()/shutterstock_212927503-5bfc362fc9e77c005145f74a.jpg)

Using Your 401 K To Pay Off A Mortgage

Web The CARES Act and 401k withdrawal.

. Under the CARES act you are allowed to spread out your income tax liability over. Web This article is more than 2 years old. Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before.

The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. Web The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401k withdrawals for those impacted by the crisis. Get Started Today and Build Your Future At A Firm With 85 Years Of Retirement Experience.

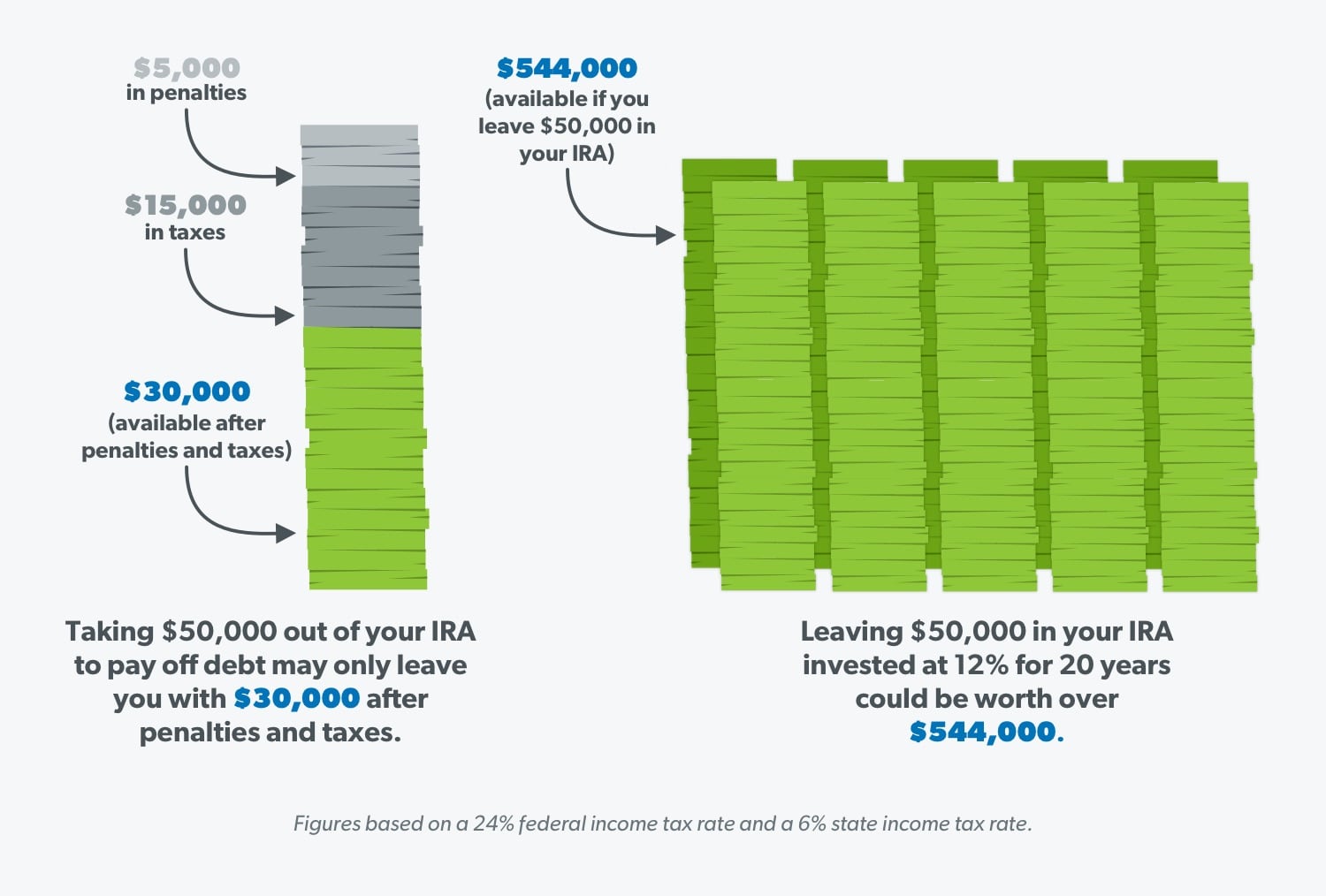

Web According to Deloitte a typical 401k borrower who defaults on a 401k loan loses 300000 of financial security at retirement because of taxes penalties and. If you withdraw 60000 from your IRA to pay off your mortgage you might. The CARES Act allows you to withdraw up to 100000 from your retirement account --.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Get Started Today With T. Web IR-2020-124 June 19 2020.

But this increase isnt automatic. Cashing out your 401 k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate. The CARES Act abolished the 10 percent 401k withdrawal penalty for.

Web The CARES Act affects retirement accounts by lifting some penalties for early withdrawal for those affected by COVID-19. Coronavirus-affected employees with 401k. Thats up from a prior.

Web Using your retirement savings to make mortgage payments could also trigger taxes. Ad Make a Thoughtful Decision For Your Retirement. Ad Developed by Lawyers.

Web We agree that using your 401k to pay off a mortgage is almost never the right move. Web Under the CARES Act you can take out a 401 k loan for up to 100000 or if lower 100 of the vested account balance for the next six months. Web If you withdraw 40000 you must pay taxes on that 40000 for the tax year.

Web Pros and cons to paying off your mortgage in retirement at a glance. Web The CARES Act changed all of the rules about 401k withdrawals. Web The author proposes using the latest 401k tax adjustments from the CARES Act that waives the 10 early withdrawal fee but also claims it would be savvy even with the fee.

Reduced anxiety about market movements. Ad Increasing Mortgage Payments Could Help You Save on Interest. Web If you do qualify to take advantage of CARES Act retirement plan benefits paying off your mortgage with those funds would help save you money over time.

Create Your Satisfaction of Mortgage. WASHINGTON The Internal Revenue Service today released Notice 2020-50 PDF to help retirement plan participants affected.

401k Withdrawal Rules For Home Purchases 2023

Cares Act Relief For Retirement Plan Loan Payments Is Ending Now What

401 K Hardship Withdrawals And Loans Are Different We Answer Your Questions About The Cares Act Barron S

5 Reasons We Used An Ira Withdrawal To Pay Off The Mortgage

X95vqhuxsyzzqm

Should I Take Money Out Of My Ira To Pay Off Debt Ramsey

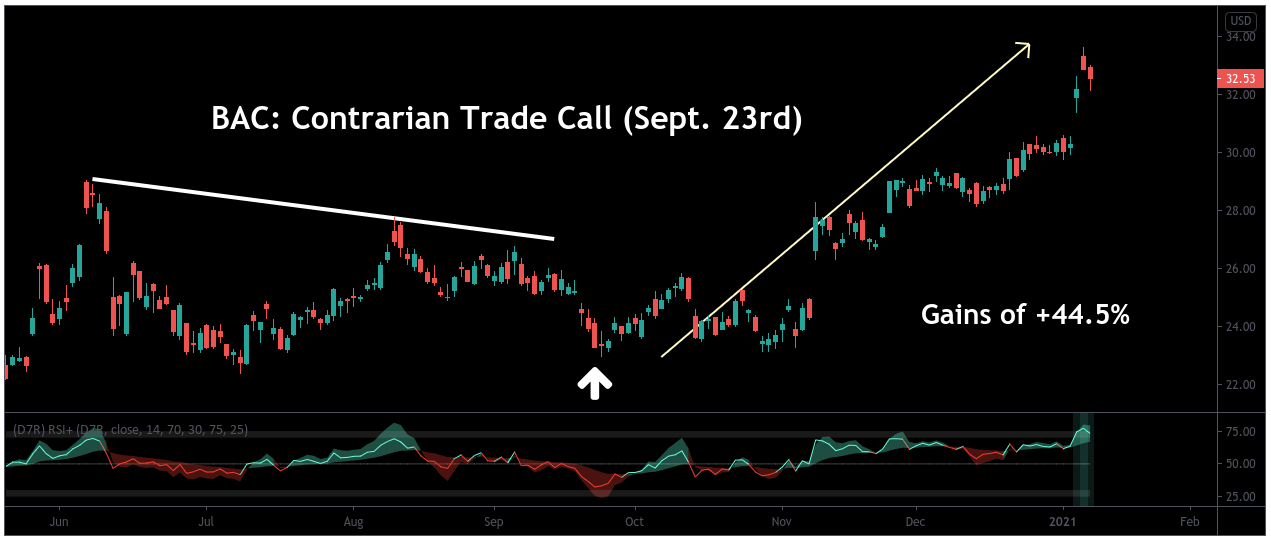

Sell Bank Of America Nyse Bac Seeking Alpha

Does Using Your 401k To Pay Off Debt Make Sense

The Cares Act Changed All Of The Rules About 401 K Withdrawals Here S Everything You Need To Know Cnet

Is It Financially Appropriate To Borrow From Your 401 K Or Ira To Pay Down Mortgage Or Heloc The Network Journal

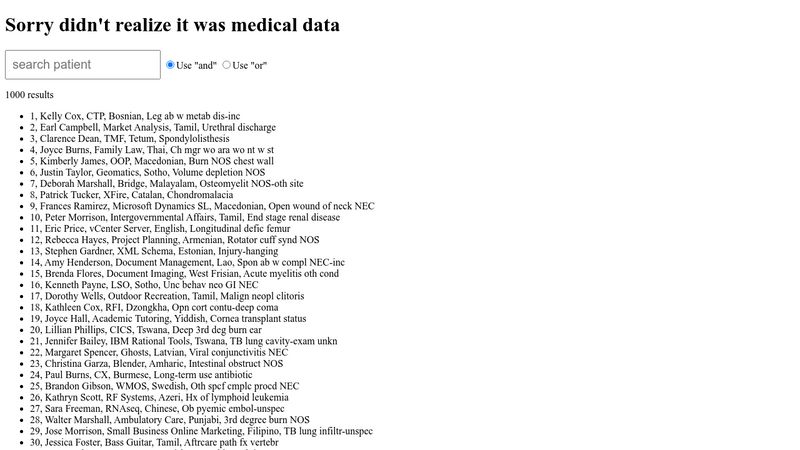

7 Vue Multiple Search Terms

How To Pay Off A 401k Loan Early The Budget Diet

The Union Democrat 07 18 2015 By Union Democrat Issuu

Should I Pay Off My Mortgage With My 401 K Lighthouse Financial Enterprises Inc

Should You Pay Off Your Mortgage Before Retirement There Are Pros And Cons

2468 Process Innovation Enterprise Architecture Foundation For O

Leesburg Today June 5 2014 By Insidenova Issuu